estate trust tax return due date

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019--10-JUL-2020 Limitation on business losses. Use form SA900 to file a Trust and Estate Tax Return.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

13 rows Due Date for Estate Income Tax Return.

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

. For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month. If more time is needed to file the estate return apply for an automatic 5 month extension of time to file using IRS Form 7004 Application for Automatic Extension of Time to. Graduated Rate Estate GRE due date is 90 days from the date of final distribution of its.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later than. Depending on the type of trust the due date of the final trust is one of the following. Filing Form 4768 automatically gives the executor of an estate or the trustee of a living trust an additional six months to file a tax return.

Due on the 15th day of the 4th month after the tax year ends. Suppose the grantor dies July 14. Generally the estate tax return is due nine months after the date of death.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. For a T3 return your filing due date depends on the trusts tax year-end. A six month extension is available if requested prior to the due date and the estimated correct.

Income tax liability of the estate or trust. Trust tax return 2022. Estimated Payments for Taxes.

In case of Partnerships and S-Corporations the due date for filing will be 15th of the third month post completion of their tax year. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post. If your trust is set up on a fiscal year.

Download Trust tax return 2022 NAT 0660. For trusts operating on a calendar year the trust tax return due date is April 15. There will be no change in the filing date in case of S.

To get a copy of the form you can either. Form 1041 was added to the Modernized e-File MeF platform on. 31 rows Generally the estate tax return is due nine months after the date of death.

Trust tax return due date. Employment tax on wages paid to household employees. The first step is to pick a closing date for the trusts tax year known as the trust year-end.

The first payment for a calendar year filer must be filed on or. Form 4768 must be filed on or before. A trust or estate.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Section for pension payment charges on page TTCG 12 and box T730 on page TTCG13 of the Trust and.

Skip to main. How to get a copy of the form. Some trusts must choose a calendar tax year.

Use this form to complete the Trust tax return 2022. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Irs Issues Proposed Regulations On Trust And Estate Deductions

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Do Trust Beneficiaries Have To Pay A Tax Filing Taxes Trust Tax Forms

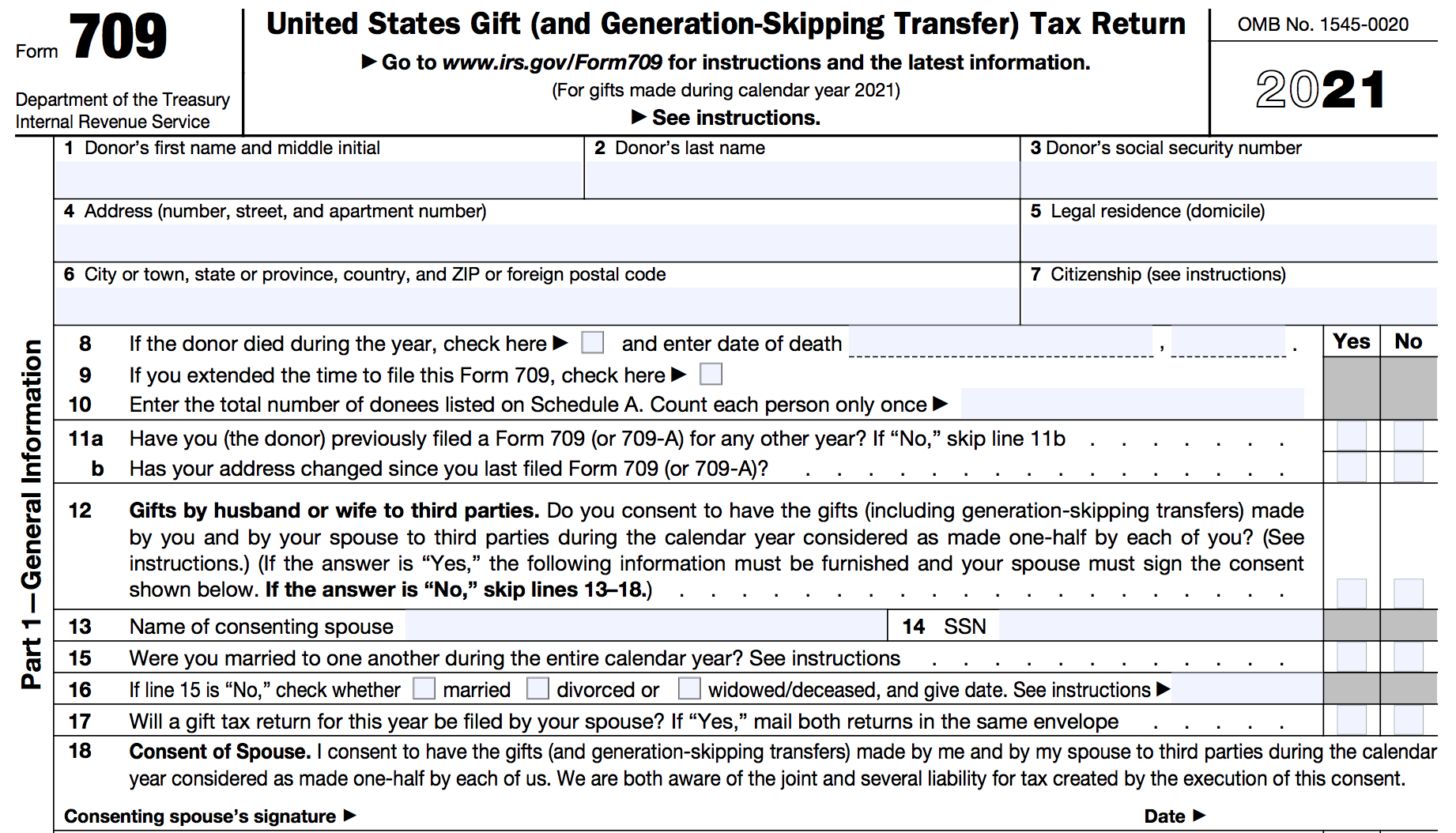

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Printable 2020 W9 Form Free Irs Forms Fillable Forms Tax Forms

Distributable Net Income Tax Rules For Bypass Trusts

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank